Retirement

Most employees of Texas agencies become members of the ERS retirement plan as soon as they start working.

Note: Employees of higher education institutions do not participate in the ERS retirement program. Visit the Higher Education Employees page for more information.

Throughout their careers with the state, employees contribute a percentage of their salaries to the ERS Retirement Trust Fund. The state also contributes to the Retirement Trust Fund on employees’ behalf. ERS invests the money in the Trust Fund to increase its value.

The state retirement plan is a defined benefit plan. That means, when you are eligible and choose to retire, you will get a monthly payment (or annuity) for the rest of your life – no matter how long you live. In general, defined benefit retirement plans provide the same or better benefits than 401(k)-type defined contribution plans, at about half the cost. At ERS, about 60% of retirement annuities are paid with investment earnings. To achieve this, ERS focuses on different types of investments in many industries for long-term earnings and stability. It is a great value for the state, members and taxpayers, who help fund the state’s contribution.

Your eligibility to retire depends on when you started working at a state agency, your years of service and your age. Once you retire, you will have a stable monthly annuity from ERS.

- If you started working at a Texas agency before Sept. 1, 2022, the amount of your monthly retirement annuity will depend on your start date, years of service, age and salary.

- If you started working on or after Sept. 1, 2022, the amount of your annuity will depend on how much money—including investment earnings and a 150% match funded by state contributions—is in your ERS account when you retire.

- Watch a five-minute video to understand how your Group 4 retirement benefit works.

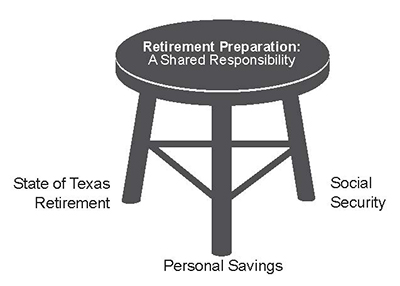

Your ERS pension is only one part of a financially secure retirement. When planning for retirement, State of Texas employees should keep in mind that their retirement annuity is unlikely to support them by itself. For the average retiree, it is about half of their working salary or less. With this in mind, employees should plan to have at least two other sources of income in retirement. We call this the “three-legged stool” of retirement income:

- The defined benefit plan provides each retiree with a regular monthly payment for life.

- Social Security makes up another portion of retirement planning. State agency employees contribute to Social Security while working for the state.

- Personal savings, like an individual retirement account or 401(k), are important for members to supplement their State of Texas Retirement and Social Security. ERS offers the Texa$aver 401(k) / 457 ProgramSM, a voluntary retirement savings program with a variety of investment options and lower-than-average fees.

Find out more about retirement benefits and retirement planning.