Performance

ERS manages retirement trust assets of approximately $39.1 billion on behalf of state employees and retirees, who are the beneficiaries of the Trust. Investment returns continue to be the single largest funding component of retirement benefits, accounting for more than 60% of the benefits provided by the ERS Trust over time.

The ERS Board of Trustees, acting upon a recommendation by the Investment Advisory Committee (IAC) and ERS investment staff, has adopted an investment policy that seeks to provide long-term capital appreciation while maintaining an acceptable level of risk.

Pension Funds Investment Pool Return

ERS invests on a long-term basis with the goal of earning superior risk-adjusted investment returns for the Trust at a reasonable cost to help provide retirement benefits for the lifetime of State of Texas retirees.

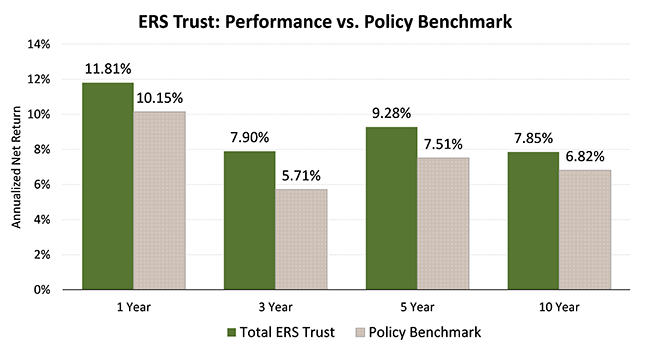

In the chart below, the net returns of Trust investments over varying time horizons are compared to those of the Policy Benchmark, which represent the expected returns of the Trust’s strategic asset allocation without any gains from effective implementation.

As of June 2024

ERS Retirement Trust Asset Allocation

The investments of the ERS Trust include a highly diversified mix of investment strategies with a mix of active and passive management. Investment asset classes include public equity, private equity, government bonds, credit, real estate, hedge funds, and infrastructure. Such a portfolio mix generally allows ERS to earn steady long-term gains, to generate sufficient cash flow to pay monthly benefits, and to limit downside risk during difficult market conditions.

Total Trust value as of June 2024 - $39.1 billion

| Asset Class | June 2024 | Strategic Target |

|---|---|---|

| Public Equity | 35.3 % | 35 % |

| Private Equity | 17.3 % | 16 % |

| Public Credit | 7.5 % | 9 % |

| Private Credit | 3.8 % | 3 % |

| Public Real Estate | 1.7 % | 3 % |

| Private Real Estate | 9.8 % | 9 % |

| Infrastructure | 6 % | 5 % |

| Rates | 8.1 % | 12 % |

| Hedge Funds | 5.2 % | 6 % |

| Special Situations | 0.3 % | 0 % |

| Cash | 4.9 % | 2 % |

| TOTAL | 100 % | 100 % |