Fourth quarter update of calendar year 2023 about ERS Trust Fund performance

5-minute read

The Employees Retirement System of Texas (ERS) Retirement Trust Fund (commonly called “the Fund”) continues to deliver well on its long-term investment goals. Once you become eligible, your retirement annuity is guaranteed for life, no matter what happens with ERS’ investments. Good management of public retirement trust funds like ERS is good for the state’s overall economy, to the benefit of all Texans.

Highlights

- $37.8 billion in market value – As of Dec. 31, 2023, the Fund’s market value is $37.8 billion, marking an increase from $36.2 billion at the end of the previous quarter and a gain of approximately $4.6 billion over the last year.

- Five-year returns of 9.75% – The Fund’s annualized return of 9.75% over the last five years was above the assumed annual rate of return (currently 7%).

- Top performer among peers – The Fund is recognized among its peers as one of the top-performing public pension funds in the country, including the top 1% over the last three years.

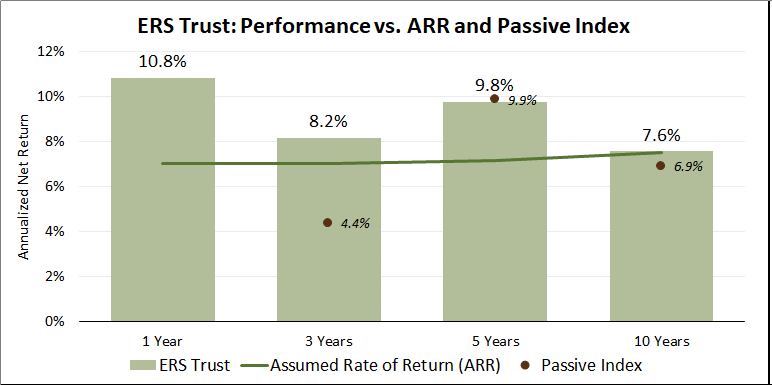

The Fund outperformed the 7% assumed annual rate of return over one, three, five and 10 years.

Assumed annual rate of return (ARR): the investment return ERS’ retirement actuaries expect from the Fund each year to ensure ERS can meet its commitments over the long term.

The Fund’s investment earnings are doing better than its policy benchmark over one, three, five and 10 years.

Policy benchmark: the standard against which ERS measures the Fund’s performance. There are benchmarks for every type of investment and strategy. The Standard and Poor’s 500 (S&P) index and Dow Jones Industrial Average (DJIA) are examples of two popular benchmarks in the equity market.

Passive Index: a portfolio designed to mirror the returns of indices with a passive mix of 80% stocks and 20% bonds. ERS uses the Passive Index as another benchmark against which to measure the Fund’s performance.

In the three-year period ended Dec. 31, 2023, the Fund return of 8.15% was above the assumed rate of return of 7%. The Fund’s three-year return outperformed the policy benchmark by 2.29% and ranked in the first percentile of peers.

On a five-year basis, the Fund’s relative returns over the policy benchmark are among the highest in ERS’ history, and within the top 10% of public retirement funds of $1 billion and above. In fact, over most of the timeframes ERS monitors, the Fund is recognized among its peers as one of the top performing public pension funds in the country.

ERS’ Private Equity Program has been the largest source of the Fund’s five-year excess return, followed by private real estate and global credit.

To find out more about the performance of specific asset classes during the fourth quarter of calendar year 2023, view the materials from the March 2024 ERS joint Board of Trustees and Investment Advisory Committee meeting.

Why investment performance matters

Your State of Texas Retirement program is a defined benefit retirement plan that will provide you a stable income when you become eligible and retire. ERS prudently invests the money through the ERS Retirement Trust Fund (commonly called “the Fund”). The Fund supports current and future earned benefits.

When you retire from state employment, you will receive a monthly annuity payment from ERS for the rest of your life regardless of the Fund’s investment performance. By design, about 60% of retirement annuities currently are paid from the Fund’s investment earnings. Contributions from the state and active members over their career account for the other approximately 40%.

For employees in ERS Retirement Group 4 (state agency employees who started on or after Sept. 1, 2022), their lifetime retirement annuities will be based on how much money is in their ERS retirement account when they retire. The state will add $1.50 for every dollar in the account at retirement. Group 4 retirement contributions earn a guaranteed 4% annual interest and, through a feature called gain sharing, can earn up to 3% more when ERS’ investments earn more than 4% on average over the previous five years. That means there is a potential to earn permanent annuity increases of up to 3% per year, when ERS’ investment returns allow. This is not a guaranteed annuity increase, but will happen when investment returns reach a certain level.

Watch the five-minute Group 4 explainer video to understand how gain sharing in the Group 4 retirement benefit works.

Remember: Your monthly annuity payment is intended to be just one part of your retirement income. ERS encourages a “three-legged stool” approach to achieving a financially secure retirement.

Ensuring reliable payments to state retirees

Annuity payments to retirees currently total more than $3 billion per year. ERS must manage the Fund carefully to not only achieve reliable investment earnings over the long term, but also to make sure the Fund has enough money on hand to pay hundreds of millions of dollars in annuities each month.

That much money going out each month means ERS must make different investment choices than an individual managing a personal retirement account—such as a 401(k) or 457—who does not have the need to withdraw funds regularly.

This prudent approach also allows ERS’ investments earnings to meet long-term projections and withstand the market’s ups and downs. As a Texas agency employee, this is good news for you, even if your annuity isn’t dependent on ERS’ investment performance.