Raise your sights on savings (state agencies only)

Great news, State of Texas employees: You got a 5% raise in your Aug. 1 paycheck!

Putting even a little of that money aside for retirement could make a big impact–and you won’t even miss it.

With an increase of just 1% or even the entire 5%, you can put the power of time and compound interest to work for you. Think of compound interest as “interest on interest”: earning interest on your original principal and on the interest your investment generates. That means you can have more money in retirement than the actual cash you put in. Here’s more on how that works.

Saving a little can go a long way

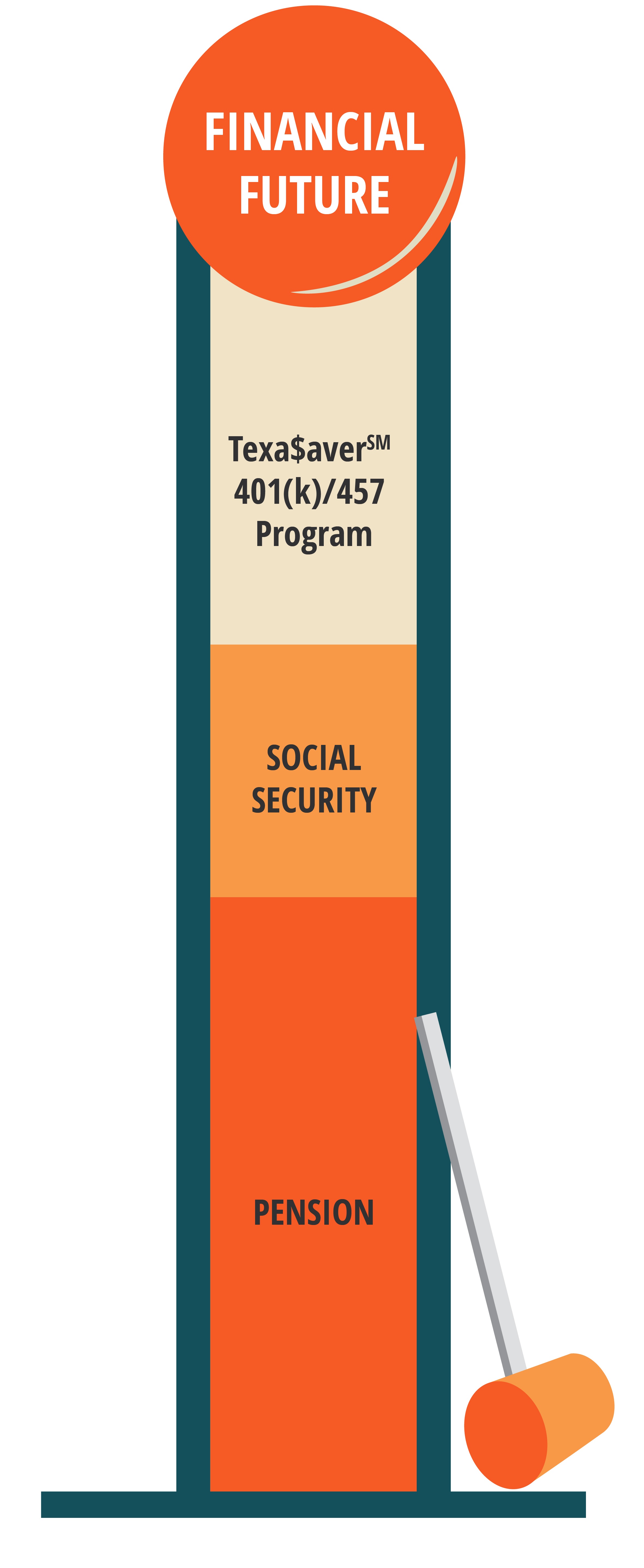

Even small savings over the course of your career can help. For example, a recent study shows that if households saved an additional $1,685 a year—about $140 a month—over a 30-year period, they could be on track to have enough savings to maintain their lifestyles in retirement. Even if you can’t afford that much each month, smaller amounts can make a difference that will help further supplement your state pension and federal Social Security. Use this calculator to see how different monthly amounts can grow over time.

Make time work for you, and capitalize on this chance to give your retirement a raise! Use Texa$aver to pay future you today.

If you don’t already have a Texa$aver account, your 5% raise offers a great opportunity to open one. You can contribute as little as 1% of your monthly salary, and it’s never too late to start. Visit the Texa$aver site or call (800) 634-5091 to find out how to open a 401(k) or 457 today.

Saving more is simple

With the Texa$averSM 401(k)/457 Program, increasing your savings is easy with:

- Automatic payroll deductions. Your contributions are deducted automatically from your earnings each pay period and deposited into your account. You don’t see the money, so you probably won’t even miss it.

- Auto-increase feature. You can set your savings to automatically increase a percentage or two at a specific time each year, like when you get a raise.

- Lifetime Income ScoreTM. The Lifetime Income Score helps you see if you’re on track toward reaching your retirement income goals. The closer your score is to 100%, the closer you may be to your target monthly or annual retirement income. Log in and adjust the sliders to see how different contributions may affect your score.1

See our News About Your Benefits June article for more about the resources you have with the Texa$aver program.

Get the latest on the Texa$aver Save More campaign.

1 IMPORTANT: The projections, or other information generated on the website by the investment analysis tool regarding the likelihood of various investment outcomes, are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. The results may vary with each use and over time.